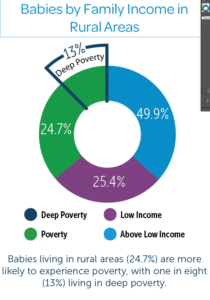

For young children, economic insecurity brings inadequate housing, food insecurity and familial stress, which all pose a risk to babies’ rapidly developing brains and bodies. The effects of early childhood poverty can persist into adulthood, impacting educational attainment, later earnings, health, reliance on public benefits, arrest rates, and even early death. Disparities by race/ethnicity and geography are pronounced: babies of color and those in rural areas are disproportionately likely to live with poverty or low income.

For young children, economic insecurity brings inadequate housing, food insecurity and familial stress, which all pose a risk to babies’ rapidly developing brains and bodies. The effects of early childhood poverty can persist into adulthood, impacting educational attainment, later earnings, health, reliance on public benefits, arrest rates, and even early death. Disparities by race/ethnicity and geography are pronounced: babies of color and those in rural areas are disproportionately likely to live with poverty or low income.

Our November 2022 poll found that more than four in five (85%) parents say it is important for Congress to reinstate Child Tax Credit reforms, with bipartisan agreement on the issue. 94% of parents who voted for a Democrat in 2022 and 77% of parents who voted for a Republican in 2022 listed this priority as being important.

Learn more about the CTC and why Congress should Act Now to enact the Enhanced Child Tax Credit to lift babies and their families out of poverty.